Given the current economic and global pandemic state, Americans are looking into different ways to receive extra cash. If approved you can use it to pay debts or home repairs but you can also use it to cover unexpected medical costs. Sadly, due to COVID-19, this could be a big factor to get this type of loan. Yet, it’s important that you know what has changed for home equity loans during this pandemic.

Some credit unions like Navy Federal have stopped accepting applications due to the rising demand. However, some lenders are still accepting new applications. You should know that even though they are accepting, the requirements have changed and essentially gotten strictest. The biggest factor they are now looking into is credit. Lenders request multiple employment requirements to ensure the borrower’s credit. Yet, 23 million people and rising daily, have climbed the unemployment rate to new highs, proving difficult the employment verification process for lenders.

On the other hand, banks are limiting the amount of money and increasing credit requirements. This has also impacted the refinance industry since they are placing caps on the money they are willing to refinance. However, getting this loan right now could be difficult but not impossible. You can still search and find lenders that are accepting applications with the requirements that fit your need. Here’s a complete and updated guide from Money.com on the Best Home Equity Loans for 2021.

Category: ABR

More Generations Are Living Under One Roof This Year

This year challenged us to reprioritize everything – from the way we use our time to where we work, how we socialize and gather together, and our needs at home. For many, this also meant making decisions about how to best support and engage with our extended families, near and far.

In some cases, we weren’t able to see our relatives and loved ones who were living in senior facilities. In others, maybe older children moved back home. Jessica Lautz, Vice President of Demographics and Behavioral Insights for the National Association of Realtors (NAR), says:

A lot of families have an aging senior relative who was living independently or in senior care and wanted to move them into their home.

These changes led more homebuyers to invest in multi-generational homes to accommodate more long-term plans. A multi-generational home, according to the 2020 Profile of Home Buyers and Sellers from NAR, is a home that has adult siblings, adult children over the age of 18, parents, and/or grandparents in the household.

A recent study from NAR shows that since the health crisis began, there’s been an increase in purchasing trends for homes that cater to this dynamic:

Buyers who purchased after March were more likely to purchase a multi-generational home at 15% compared to 11% who purchased before April.

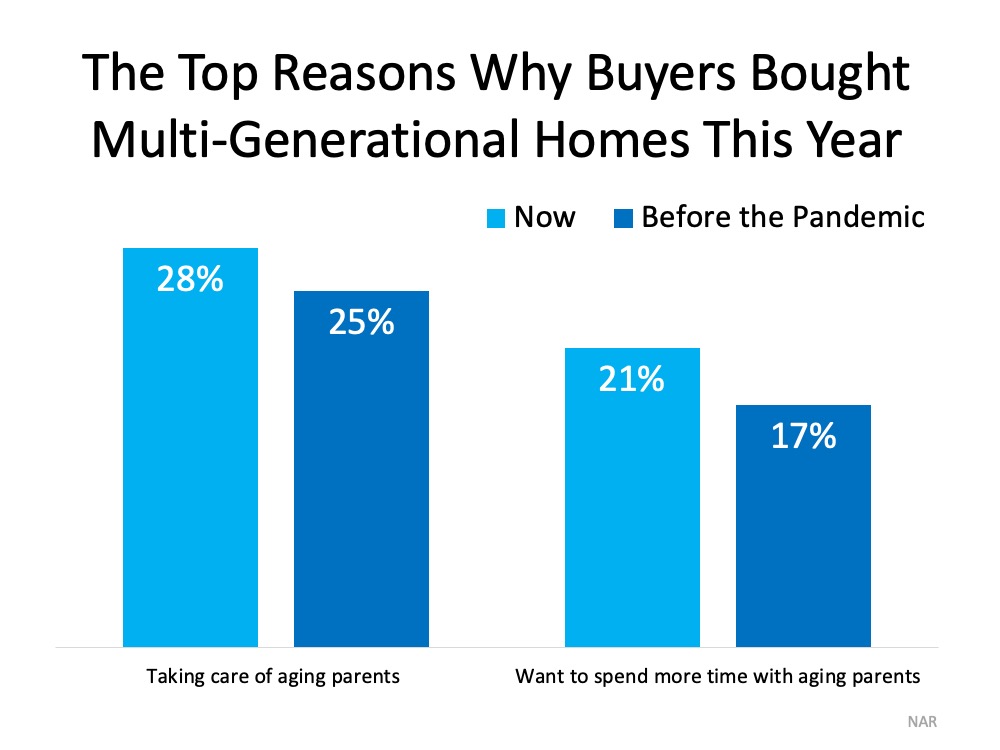

There are many reasons for this uptick in preference toward multi-generational homes. The graph below shows the top two reasons and how they’ve increased this year:

Bottom Line

More homeowners are making arrangements to accommodate their loved ones so they can safely take care of them at home. If you’re in a similar situation, let’s connect to discuss your options in our local area and maybe even have your whole family under one roof by early next year.

It’s Not Just About the Price of the Home

When most of us begin searching for a home, we naturally start by looking at the price. It’s important, however, to closely consider what else impacts the purchase. It’s not just the price of the house that matters, but the overall cost in the long run. Today, that’s largely impacted by low mortgage rates. Low rates are actually making homes more affordable now than at any time since 2016, and here’s why.

Today’s low rates are off-setting rising home prices because it’s less expensive to borrow money. In essence, purchasing a home while mortgage rates are this low may save you significantly over the life of your home loan.

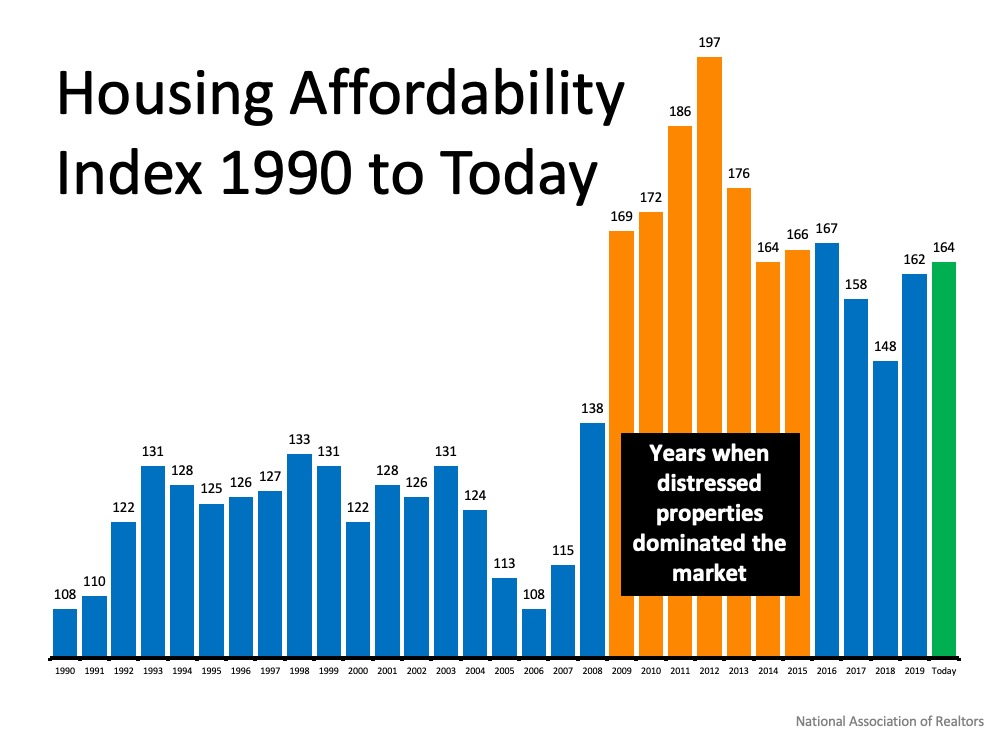

Taking a look at the graph below with data sourced from the National Association of Realtors (NAR), the higher the bars rise, the more affordable homes are. The orange bars represent the period of time when homes were most affordable, but that’s also reflective of when the housing bubble burst. At that time, distressed properties, like foreclosures and short sales, dominated the market. That’s a drastically different environment than what we have in the housing market now.

The green bar represents today’s market. It shows that homes truly are more affordable than they have been in years, and much more so than they were in the normal market that led up to the housing crash. Low mortgage rates are a big differentiator driving this affordability.

What are the experts saying about affordability?

Experts agree that this unique moment in time is making homes incredibly affordable for buyers.

Lawrence Yun, Chief Economist, NAR:

Although housing prices have consistently moved higher, when the favorable mortgage rates are factored in, an overall home purchase was more affordable in 2020’s second quarter compared to one year ago.

Bill Banfield, EVP of Capital Markets, Quicken Loans:

No matter what you’re looking for, this is a great time to buy since the current low interest rates can stretch your spending power.

Those shopping for a home can afford 10 percent more home than they could have one year ago while keeping their monthly payment unchanged. This translates into nearly $32,000 more buying power.

Homeowners are the clear winners. Low mortgage rates mean the cost of owning is at historically low levels and who gains all the benefits of strong house price appreciation? Homeowners.

Bottom Line

When purchasing a home, it’s important to think about the overall cost, not just the price of the house. Homes on your wish list may be more affordable today than you think. Let’s connect to discuss how affordability plays a role in our local market, and your long-term homeownership goals.

Three Ways to Win in a Bidding War

With so few houses for sale today and low mortgage rates driving buyer activity, bidding wars are becoming more common. Multiple-offer scenarios are heating up, so it’s important to get pre-approved before you start your search. This way, you can put your best foot forward – quickly and efficiently – if you’re planning to buy a home this season.

Javier Vivas, Director of Economic Research at realtor.com, explains:

COVID-19 has accelerated earlier trends, bringing even more buyers than the market can handle. In many markets, fierce competition, bidding wars, and multiple offer scenarios may be the common theme in the weeks to come.

Here are three things you can do to make your offer a competitive one when you’re ready to make your move.

1. Be Ready

A recent survey shows that only 52% of active homebuyers obtained a pre-approval letter before they began their home search. That means about half of active buyers missed out on this key part of the process.

Buyers who are pre-approved are definitely a step ahead when it’s time to make an offer. Having a pre-approval letter indicating you’re a qualified buyer shows sellers you’re serious. It’s often a deciding factor that can tip the scale in your direction if there’s more than one offer on a home. It’s best to contact a mortgage professional to start your pre-approval process early, so you’re in the best position right from the start of your home search.

2. Present Your Best Offer

In a highly competitive market, it’s common for sellers to pick a date and time to review all offers on a house at one time. If this is the case, you may not have an opportunity to negotiate back and forth with the sellers. As a matter of fact, the National Association of Realtors (NAR) notes:

Not only are properties selling quickly, but they are also getting more offers. On average, REALTORS® reported nearly three offers per sold property in July 2020.

Make sure the offer you’re presenting is the best one the sellers receive. A real estate professional can help you make sure your offer is a fair and highly competitive one.

3. Act Fast

With existing homes going like hotcakes, there’s no time to waste in the process. NAR reports how the speed of home sales is ramping up:

Properties typically remained on the market for 22 days in July, seasonally down from 24 days in June and from 29 days in July 2019. Sixty-eight percent of homes sold in July 2020 were on the market for less than a month.

In addition, NAR notes:

Total existing-home sales…jumped 24.7% from June to a seasonally adjusted annual rate of 5.86 million in July. The previous record monthly increase in sales was 20.7% in June of this year. Sales as a whole rose year-over-year, up 8.7% from a year ago (5.39 million in July 2019).

As you can see, the market is gaining steam. For two consecutive months houses have sold very quickly. Essentially, you may not have time to sleep on it or shop around when you find a home you love. Chances are, someone else loves it too. If you take your time, it may not be available when you’re ready to commit.

Bottom Line

The housing market is very strong right now, and buyers are scooping up available homes faster than they’re coming to market. If you’re planning to purchase a home this year, let’s connect to discuss the trends in our current area, so you’re ready to compete – and win.

Plush cushions and blankets, firepits, privacy screens, and more can help you cozy up your backyard to get more use of it any time of year. Gather ideas of how to make better use of your outdoor space so you can still enjoy it even as the weather cools.Read More

Information is brought to you byDavid MichaelColdwell Banker Realty

How to Avoid Bank Fees

The average bank fee for overdraft protection is $33. Make the mistake of not having enough money in your account when you write a check or buy something with a debit card, and you could pay a few hundred dollars in a year if you’re really forgetful.

Big and small banks make money off big and small fees on checking and savings accounts, sometimes as small as a buck or so. The national average out-of-network withdrawal fee for using an ATM outside of your bank’s network is $1.67, according to a survey by Bankrate.

Here are some ways to avoid the above fees and others that banks commonly charge:

Overdraft Fees

Also called “nonsufficient funds,” or NSF for short, overdraft fees changed after the financial crisis, with new rules requiring customers to opt in for overdraft protection instead of being given it automatically. Overdraft protection pays a transaction if an account is overdrawn, and banks charge fees until the customer deposits more money into the account.

To avoid the fee, either check your balance regularly to make sure you have enough money for a purchase, or opt out of the overdraft program.

ATM Fees

Being charged $1 to $3 to withdraw money is annoying. Using an ATM outside of your bank’s network costs $1.67 on average nationally. You may also be charged the national average of $2.90 by the other bank for using its ATM as a non-customer.

To avoid these fees, check with your bank on where you can use its ATM without a fee. It can pay to plan ahead by having some cash on hand so that you aren’t forced to use another bank’s ATM when you’re low on cash. Some banks, especially small ones or credit unions, may reimburse you for using other ATMs.

Monthly Service Charges

Waiving a $5 to $10 monthly fee for having a checking account can often be done if you meet certain requirements.

These can include having direct deposit, opening a second account, completing a certain number of transactions each month, or spending a certain amount on a credit card with the bank.

Low Balance Fees

Not meeting minimum balance requirements can cost $5 to $10 each month. If you’re transferring money out of a savings account regularly without keeping track of how low its balance drops, for example, then you may miss the fee being charged on your monthly statement.

If you can’t maintain a high enough balance to avoid this fee, then close the account and move the money to an account where you regularly keep more money, such as a checking account.

Finally, be sure to shop around for the best bank that meets your service needs and doesn’t charge such fees—or at least makes it easier to avoid them. There are plenty of banks, credit unions and other institutions that will hold your money for you, so look for the best deal.

Brought to you by

David Michael

Realtor

Coldwell Banker Realty

15 VerValen Street

Closter , NJ 07628

Office Phone: (201) 767-0550

Mobile Phone: (551) 265-4761

Email Me

How Is Remote Work Changing Homebuyer Needs?

With more companies figuring out how to efficiently and effectively enable their employees to work remotely (and for longer than most of us initially expected), homeowners throughout the country are re-evaluating their needs. Do I still need to live close to my company’s office building? Do I need a larger home with more office space? Would making a move to the suburbs make more sense for my family? All of these questions are on the table for many Americans as we ride the wave of the current health crisis and consider evolving homeownership needs.

According to George Ratiu, Senior Economist for realtor.com:

“The ability to work remotely is expanding home shoppers’ geographic options and driving their motivation to buy, even if it means a longer commute, at least in the short term…Although it’s too early to tell what long-term impact the COVID-era of remote work will have on housing, it’s clear that the pandemic is shaping how people live and work under the same roof.”

Working remotely is definitely changing how Americans spend their time at home, and also how they use their available square footage. Homeowners aren’t just looking for a room for a home office, either. The desire to have a home gym, an updated kitchen, and more space in general – indoor and outdoor – are all key factors motivating some buyers to change their home search parameters.

A recent realtor.com-HarrisX survey indicates:

In a June poll of 2,000 potential home shoppers who indicated plans to make a purchase in the next year, 63% of those currently working from home stated their potential purchase was a result of their ability to work remotely, while nearly 40% [of] that number expected to purchase a home within four to six months and 13% said changes related to pandemic fueled their interest in buying a new home.

Clearly, Americans are thinking differently about homeownership today, and through a new lens. The National Association of Home Builders (NAHB) notes:

New single-family home sales jumped in June, as housing demand was supported by low interest rates, a renewed consumer focus on the importance of housing, and rising demand in lower-density markets like suburbs and exurbs.

Through these challenging times, you may have found your home becoming your office, your children’s classroom, your workout facility, and your family’s safe haven. This has quickly shifted what home truly means to many American families. More than ever, having a place to focus on professional productivity while many competing priorities (and distractions!) are knocking on your door is challenging homeowners to get creative, use space wisely, and ultimately find a place where all of these essential needs can realistically be met. In many cases, a new home is the best option.

In today’s real estate market, making a move while mortgage rates are hovering at historic lows may enable you to purchase more home for your money, just when you and your family need it most.

Bottom Line

If your personal and professional needs have changed and you’re ready to accommodate all of your family’s competing priorities, let’s connect today. Making a move into a larger home may be exactly what you need to set your family up for optimal long-term success.